Delve into the world of mutual funds tracking the BSE Midcap Index, where opportunities and risks collide in the dynamic landscape of investments. As investors navigate through the complexities of financial markets, the focus on this specific index opens doors to a realm of possibilities and challenges.

Exploring the nuances of mutual funds linked to the BSE Midcap Index sheds light on unique strategies and performance comparisons that shape investment decisions.

Mutual Funds Overview

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of securities such as stocks, bonds, or other assets. They are managed by professional fund managers who make investment decisions on behalf of the investors.Investing in mutual funds offers several benefits, including diversification, professional management, affordability, liquidity, and convenience.

By investing in a mutual fund, investors can access a diversified portfolio of securities without having to individually select and manage them.

Types of Mutual Funds

- Equity Funds:These funds invest primarily in stocks and are suited for investors seeking long-term capital appreciation.

- Bond Funds:These funds invest in fixed-income securities such as government or corporate bonds, offering regular income and lower risk compared to stocks.

- Money Market Funds:These funds invest in short-term, low-risk securities such as Treasury bills and commercial paper, providing stability and liquidity.

- Index Funds:These funds aim to replicate the performance of a specific market index, such as the BSE Midcap Index, by holding the same securities in the same proportions.

BSE Midcap Index

The BSE Midcap Index is a stock market index that represents the performance of the mid-sized companies listed on the Bombay Stock Exchange (BSE). These companies have a market capitalization that falls between large-cap and small-cap companies.

Calculation of BSE Midcap Index

The BSE Midcap Index is calculated using the free-float market capitalization methodology. This means that the index is calculated based on the market capitalization of the companies in the index, taking into account only the shares that are available for trading in the market.

- The market capitalization of each company in the index is calculated by multiplying the total number of outstanding shares by the current market price of the shares.

- The weight of each company in the index is determined based on its market capitalization relative to the total market capitalization of all the companies in the index.

- The index value is then calculated using the weighted average of the price movements of the individual stocks in the index.

Significance of BSE Midcap Index for Investors

The BSE Midcap Index is important for investors as it provides a benchmark to track the performance of mid-sized companies in the Indian stock market. Investors can use the index to assess the overall performance of midcap stocks and make informed investment decisions.

The BSE Midcap Index offers investors a way to diversify their portfolio by including midcap stocks, which have the potential for higher growth compared to large-cap stocks.

Mutual Funds Tracking BSE Midcap Index

Mutual funds that track the BSE Midcap Index follow a passive investment strategy where the fund's portfolio mirrors the composition of the BSE Midcap Index. This means that the fund manager invests in the same stocks and in the same proportion as the index, aiming to replicate its performance.

Strategy of Mutual Funds Tracking BSE Midcap Index

- These mutual funds provide investors with exposure to mid-cap companies listed on the BSE, offering diversification and potential growth opportunities.

- By tracking the BSE Midcap Index, these funds aim to provide returns that closely match the performance of the index, minus any associated fees.

- Investors who believe in the growth potential of mid-cap companies often choose these funds to capitalize on the sector's performance.

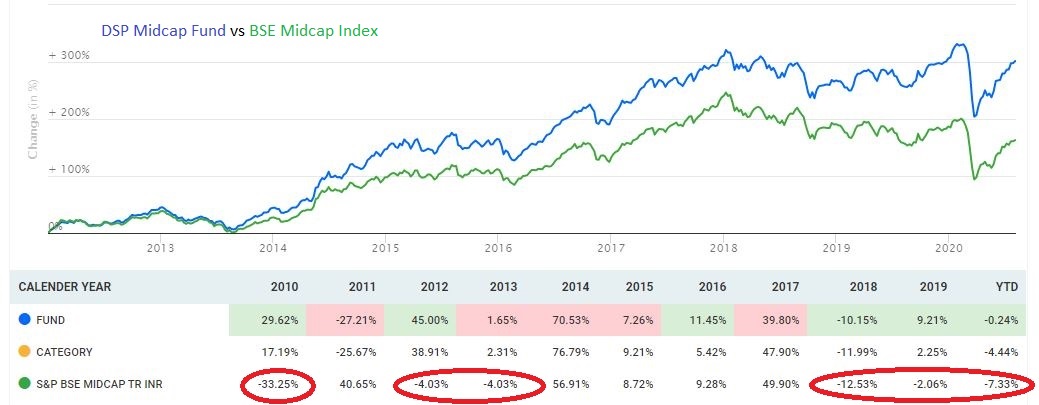

Performance Comparison with Other Types of Mutual Funds

- Mutual funds tracking the BSE Midcap Index typically offer higher growth potential compared to large-cap funds but come with higher volatility.

- When compared to small-cap funds, mid-cap index funds tend to have a more stable performance due to the size and maturity of the companies in the index.

- Investors seeking a balance between growth and stability may find mid-cap index funds a suitable option within their investment portfolio.

Popular Mutual Funds Tracking BSE Midcap Index

- ICICI Prudential Midcap Fund - Direct Growth

- HDFC Mid-Cap Opportunities Fund - Direct Plan

- Axis Midcap Fund - Direct Plan

Benefits and Risks

Investing in mutual funds tracking the BSE Midcap Index comes with its own set of advantages and risks that investors need to consider before making any investment decisions.

Advantages of Investing in Mutual Funds Tracking BSE Midcap Index

- Diversification: By investing in mutual funds linked to the BSE Midcap Index, investors can achieve instant diversification across a basket of midcap stocks, reducing overall portfolio risk.

- Potential for Higher Returns: Midcap stocks have the potential to deliver higher returns compared to large-cap stocks, providing investors with the opportunity for capital appreciation.

- Professional Management: Mutual funds are managed by experienced professionals who make investment decisions on behalf of investors, saving them the time and effort required for individual stock selection.

- Liquidity: Mutual funds tracking the BSE Midcap Index offer liquidity to investors, allowing them to buy and sell units easily on the stock exchange.

Risks Associated with Investing in Mutual Funds Tracking BSE Midcap Index

- Market Volatility: Midcap stocks tend to be more volatile than large-cap stocks, leading to fluctuations in the value of mutual funds tracking the BSE Midcap Index.

- Concentration Risk: Since these funds are focused on midcap stocks, there is a higher concentration risk compared to diversified funds, which could lead to higher losses in case of adverse market conditions.

- Tracking Error: There is a possibility of tracking error where the performance of the mutual fund deviates from the actual performance of the BSE Midcap Index, impacting returns.

Strategies to Mitigate Risks when Investing in Mutual Funds Tracking BSE Midcap Index

- Regular Monitoring: Investors should regularly monitor the performance of the mutual fund and the BSE Midcap Index to identify any deviations and take necessary actions.

- Diversification: To reduce concentration risk, investors can consider diversifying their overall portfolio by including other asset classes such as large-cap stocks, bonds, or real estate.

- Invest for the Long Term: Investing for the long term can help mitigate short-term market volatility and provide the opportunity to ride out market fluctuations.

Closing Summary

In conclusion, mutual funds tracking the BSE Midcap Index offer a distinctive avenue for investors seeking exposure to midcap equities with tailored strategies. Navigating through the benefits and risks, investors can make informed choices to optimize their investment portfolios.

Expert Answers

What are the advantages of investing in mutual funds tracking the BSE Midcap Index?

Investors can gain diversified exposure to midcap stocks with potentially higher returns compared to large-cap funds.

How is the BSE Midcap Index calculated?

The BSE Midcap Index is calculated based on the market capitalization of mid-sized companies listed on the Bombay Stock Exchange.

Can you provide examples of mutual funds that specifically track the BSE Midcap Index?

Some popular mutual funds that track the BSE Midcap Index include XYZ Fund and ABC Fund.

What risks are associated with investing in mutual funds linked to the BSE Midcap Index?

Volatility in midcap stocks and market fluctuations can pose risks to investors in these funds.

How can investors mitigate risks when investing in mutual funds tracking the BSE Midcap Index?

Diversifying their investment portfolio, staying informed about market trends, and maintaining a long-term investment horizon can help mitigate risks.