The BSE Midcap Index performance this year sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality. As we delve into the intricacies of this index, we uncover a world of investment opportunities and market insights that are crucial for both seasoned investors and newcomers alike.

Exploring the history, significance, and key factors driving the performance of the BSE Midcap Index sheds light on the dynamic nature of the market and the potential for growth and stability it presents to investors.

Overview of BSE Midcap Index Performance This Year

The BSE Midcap Index is a stock market index that tracks the performance of mid-sized companies listed on the Bombay Stock Exchange (BSE). These companies fall between large-cap and small-cap companies in terms of market capitalization.The BSE Midcap Index was launched on January 9, 2001, with a base value of 1000.

It consists of 50 stocks that represent various sectors of the economy, providing investors with a diversified portfolio of mid-sized companies.Tracking the BSE Midcap Index is important for investors as it allows them to gauge the overall performance of mid-sized companies in the market.

These companies are often seen as having the potential for growth and can offer higher returns compared to large-cap companies. By monitoring the BSE Midcap Index, investors can assess the performance of this segment of the market and make informed investment decisions based on the trends and movements of the index.

Factors Influencing BSE Midcap Index Performance

The performance of the BSE Midcap Index is influenced by a variety of factors that impact the midcap segment, including economic conditions, industry trends, and global market conditions.

Economic Factors Affecting the Midcap Segment

Economic factors play a crucial role in determining the performance of midcap companies. Factors such as GDP growth, interest rates, inflation, and government policies can significantly impact the midcap segment. For instance, a strong GDP growth rate can boost consumer spending and business investment, benefiting midcap companies.

On the other hand, high-interest rates can increase borrowing costs for midcap firms, affecting their profitability.

Key Industry Trends Impacting the Index

Industry trends have a direct impact on the BSE Midcap Index, as it is composed of mid-sized companies from various sectors. Technological advancements, changing consumer preferences, regulatory changes, and competitive dynamics within industries can all influence the performance of midcap companies.

For example, a shift towards renewable energy sources in the energy sector can benefit midcap firms operating in this space, leading to positive performance in the index.

Analyze the Influence of Global Market Conditions on the Index

Global market conditions, such as trade agreements, geopolitical events, currency fluctuations, and economic growth in major economies, can also affect the BSE Midcap Index. Midcap companies that have exposure to international markets may be impacted by changes in global economic conditions.

For instance, a trade war between major economies can lead to uncertainties in the global market, affecting the performance of midcap companies with international operations.

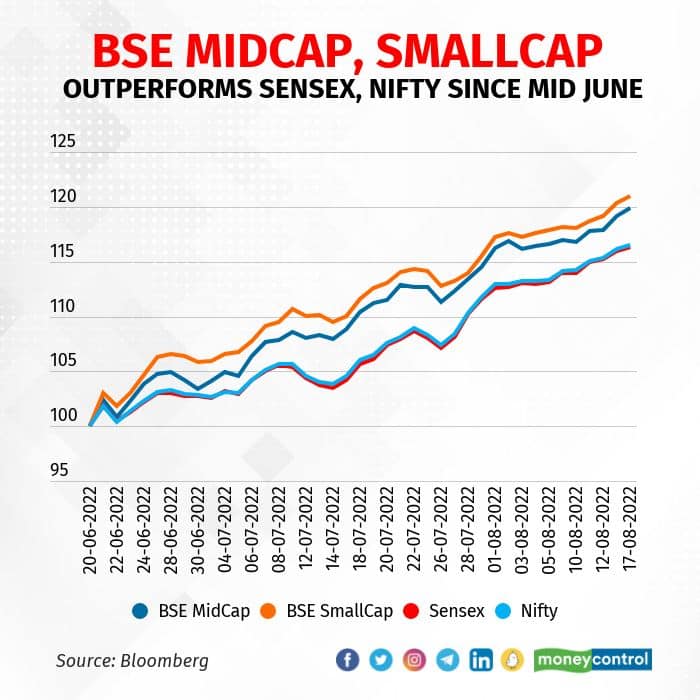

Comparison with Other Market Indices

When comparing the performance of the BSE Midcap Index with other key market indices, such as the BSE Sensex and Nifty 50, we can gain valuable insights into the overall market trends and investor sentiment.

BSE Midcap Index vs. BSE Sensex

Let's take a look at how the BSE Midcap Index has fared in comparison to the BSE Sensex:

- The BSE Midcap Index typically consists of mid-sized companies, while the BSE Sensex comprises large-cap companies.

- Due to the difference in company sizes, the BSE Midcap Index tends to be more volatile compared to the BSE Sensex.

- In times of market upswings, midcap stocks may outperform large-cap stocks, resulting in the BSE Midcap Index showing higher returns than the BSE Sensex.

BSE Midcap Index vs. Nifty 50

Contrasting the performance of the BSE Midcap Index with the Nifty 50 can provide a comprehensive view of market dynamics:

- The Nifty 50 represents the performance of the top 50 companies listed on the National Stock Exchange (NSE), covering various sectors and industries.

- While the BSE Midcap Index focuses on mid-sized companies, the Nifty 50 includes a mix of large-cap and mid-cap companies.

- The performance of midcap stocks in the BSE Midcap Index may differ from the constituents of the Nifty 50, leading to variations in returns between the two indices.

Variation from Small-cap and Large-cap Indices

Understanding how the midcap index performance varies from small-cap and large-cap indices is crucial for investors diversifying their portfolios:

- Small-cap indices typically include companies with a smaller market capitalization compared to midcap and large-cap indices, making them more susceptible to market fluctuations.

- Large-cap indices, on the other hand, consist of established companies with higher market capitalization, offering stability but potentially lower growth prospects compared to midcap stocks.

- The BSE Midcap Index often falls between the extreme volatility of small-cap indices and the stability of large-cap indices, providing a balanced investment option for risk-aware investors.

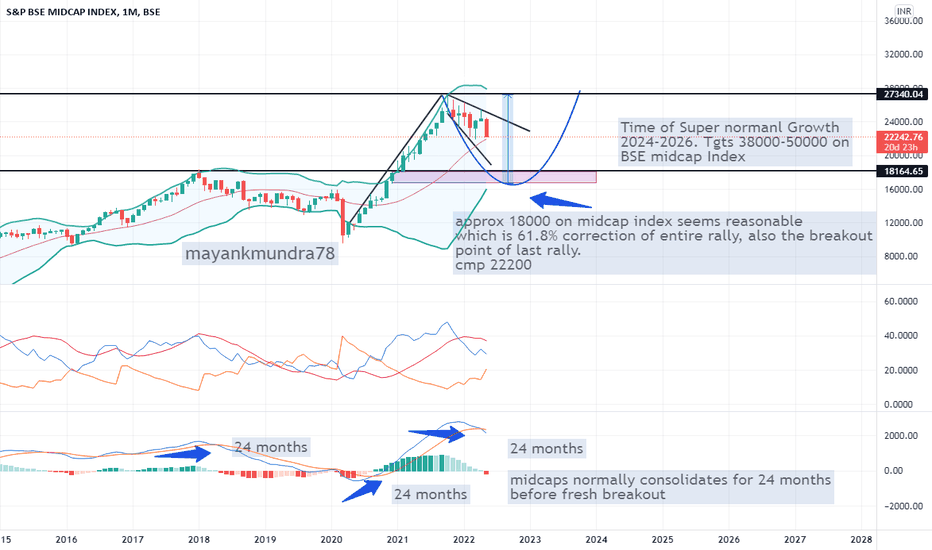

Impact of Economic Events on BSE Midcap Index

Economic events play a significant role in influencing the performance of the BSE Midcap Index. Let's delve into how major economic events, policy changes, and corporate earnings reports impact this index.

Effect of Major Economic Events on the Index

Major economic events such as GDP growth rate announcements, inflation data releases, interest rate changes, and global economic trends can have a direct impact on the BSE Midcap Index. For example, a positive GDP growth rate can boost investor confidence and lead to an increase in the index value, while rising inflation may cause concerns and result in a decline.

Policy Changes and Influence on the Midcap Index

Policy changes by the government or regulatory bodies can significantly influence the BSE Midcap Index. For instance, changes in tax policies, foreign investment regulations, or sector-specific policies can either boost or dampen investor sentiment, thereby impacting the index. Investors closely monitor policy announcements to assess their potential impact on midcap stocks.

Corporate Earnings Reports and Performance of the Midcap Index

Corporate earnings reports play a crucial role in determining the performance of the BSE Midcap Index. Positive earnings results from midcap companies can lead to a surge in stock prices and drive the index higher, while disappointing earnings can have the opposite effect.

Investors track these reports to gauge the financial health and growth prospects of midcap companies, which ultimately reflect in the index performance.

Last Word

In conclusion, the BSE Midcap Index performance this year reflects a nuanced interplay of economic factors, industry trends, and global market conditions that shape the investment landscape. As investors navigate the complexities of the midcap segment, they are poised to capitalize on opportunities and mitigate risks in a market that is ever-evolving.

Commonly Asked Questions

What is the BSE Midcap Index?

The BSE Midcap Index is an index that tracks the performance of mid-sized companies listed on the Bombay Stock Exchange.

How does tracking the BSE Midcap Index benefit investors?

Tracking the BSE Midcap Index provides investors with insights into the performance of midcap stocks, allowing them to diversify their portfolios and potentially earn higher returns.

How does the BSE Midcap Index compare to the Nifty 50?

The BSE Midcap Index focuses on mid-sized companies, while the Nifty 50 comprises the top 50 large-cap companies. They represent different segments of the market.