Dive into the world of stock market analysis with a focus on the BSE Midcap Index today live chart. This insightful guide aims to shed light on the significance of tracking this index for investors, the components that make up the index, and how to interpret the live chart data effectively.

Let's unravel the mysteries behind the fluctuations in the BSE Midcap Index and compare it to other major stock market indices.

Overview of BSE Midcap Index

The BSE Midcap Index is a stock market index that represents the performance of mid-sized companies listed on the Bombay Stock Exchange (BSE). These companies fall between large-cap and small-cap companies in terms of market capitalization.Tracking the BSE Midcap Index is significant for investors as it provides a gauge of how mid-sized companies are performing in the market.

It allows investors to diversify their portfolios by including midcap stocks, which can offer growth potential while also carrying higher risk compared to large-cap stocks.

Brief History and Performance

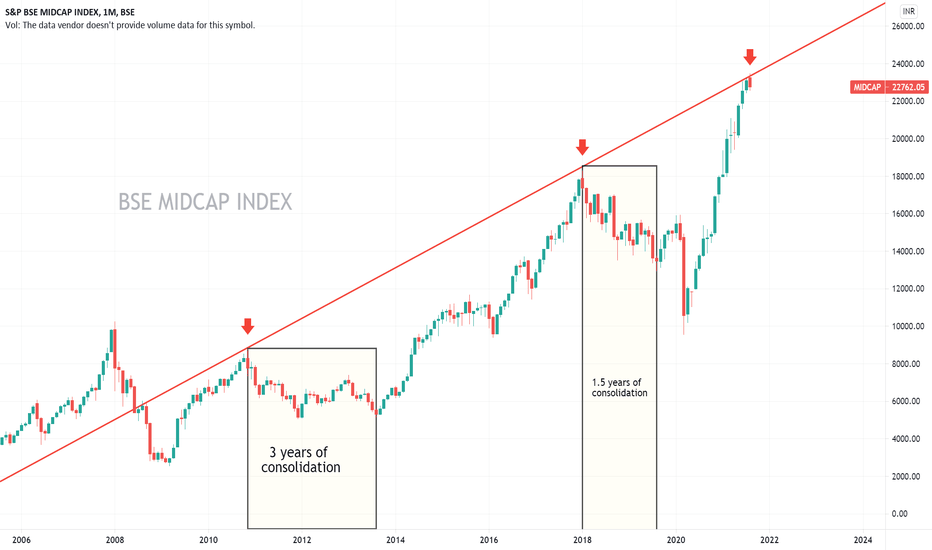

The BSE Midcap Index was launched on January 9, 2001, with a base value of 1,000. Over the years, the index has shown fluctuations in line with market conditions, reflecting the overall performance of midcap stocks. Investors often use the BSE Midcap Index as a benchmark to evaluate the performance of their midcap investments against the broader market trends.

Components of the BSE Midcap Index

The BSE Midcap Index consists of a diverse range of companies that fall within the mid-cap category based on market capitalization.

Major Companies in BSE Midcap Index

- HDFC Life Insurance Company

- Adani Enterprises

- Apollo Hospitals

- Shriram Transport Finance

- Muthoot Finance

Selection and Weighting of Components

The companies included in the BSE Midcap Index are selected based on predefined criteria set by the Bombay Stock Exchange. These criteria usually include market capitalization, liquidity, and trading volume. The weighting of each component in the index is determined by its market capitalization, with larger companies having a higher weightage compared to smaller ones.

Sectoral Distribution within BSE Midcap Index

- Financial Services: Companies like HDFC Life Insurance and Shriram Transport Finance dominate this sector within the index.

- Healthcare: Apollo Hospitals is a major player representing the healthcare sector in the BSE Midcap Index.

- Infrastructure: Adani Enterprises is a key player from the infrastructure sector included in the index.

Live Chart of BSE Midcap Index Today

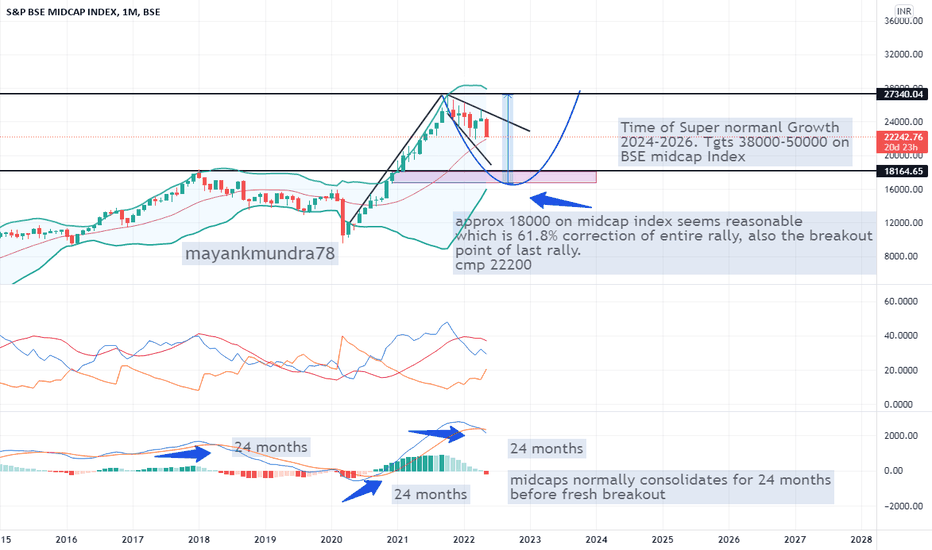

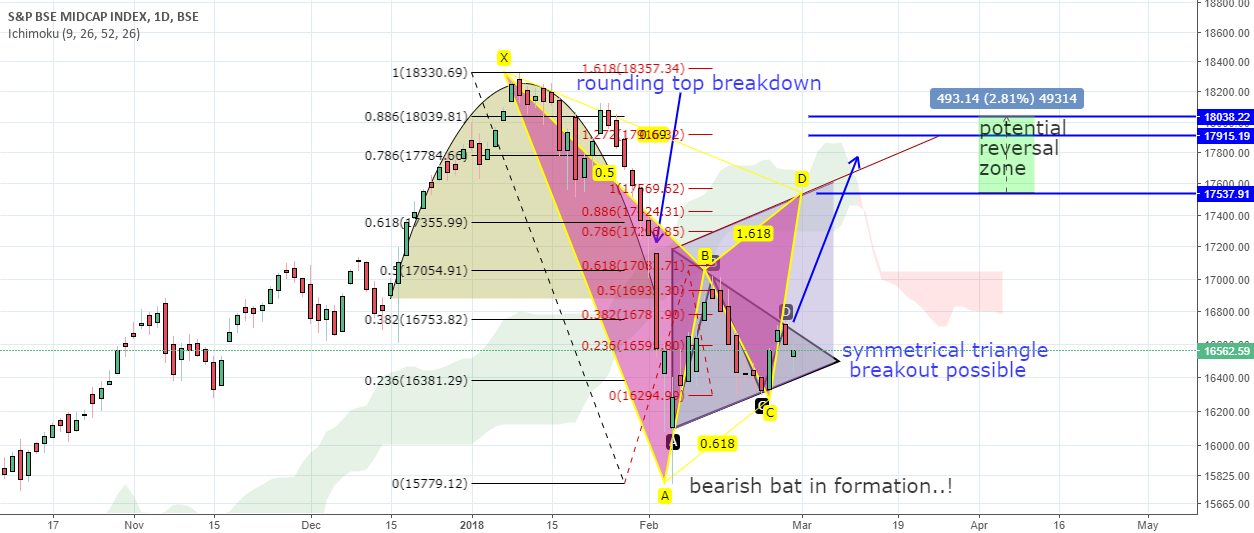

When looking at the live chart of the BSE Midcap Index for the day, it's essential to understand how to interpret the data and what factors can influence the fluctuations in the index throughout the trading session.

Interpreting the Live Chart

- The live chart will display the movement of the BSE Midcap Index throughout the trading day, showing the opening price, highest price, lowest price, and current price.

- A line graph is commonly used to represent the index's movement, with time on the horizontal axis and the index value on the vertical axis.

- Traders and investors can analyze the chart to identify trends, support and resistance levels, and potential entry or exit points for trades.

- Volume indicators may also be included in the chart to show the level of participation in the market at different price levels.

Factors Influencing Fluctuations

- Market Sentiment: Positive or negative news about the economy, sector-specific developments, or global events can impact investor sentiment and influence the index's movement.

- Interest Rates: Changes in interest rates by the central bank can affect borrowing costs for companies, impacting their profitability and, in turn, the stock prices in the index.

- Earnings Reports: Quarterly earnings reports of companies in the index can lead to significant movements based on whether they meet, exceed, or fall short of market expectations.

- Political Events: Political instability, government policies, or elections can create uncertainty in the market, leading to volatility in the index.

Comparison with Other Stock Market Indices

In the world of stock market indices, the BSE Midcap Index holds its own unique position among other major indices like Nifty 50 or BSE Sensex. Let's delve into how the performance of the BSE Midcap Index differs from these larger or smaller indices and explore the reasons behind these differences.

Performance Comparison

When comparing the BSE Midcap Index with the Nifty 50 or BSE Sensex, one notable difference lies in the composition of the indices. The BSE Midcap Index typically includes medium-sized companies, which can offer a different risk-return profile compared to the larger companies in the Nifty 50 or BSE Sensex.

This difference in composition can lead to varying levels of volatility and growth potential among the indices.

- The Nifty 50 consists of the top 50 large-cap companies in India, representing a broader market sentiment.

- The BSE Sensex, on the other hand, tracks the performance of 30 large, well-established companies across various sectors.

Reasons for Performance Differences

One key reason behind the performance differences among these indices is the market capitalization of the companies included. The BSE Midcap Index, with its focus on medium-sized companies, may experience higher growth potential but also higher volatility compared to the more stable large-cap companies in the Nifty 50 or BSE Sensex.

- Smaller companies in the BSE Midcap Index may be more sensitive to market conditions and economic factors, leading to fluctuations in their stock prices.

- Larger companies in the Nifty 50 or BSE Sensex tend to have more established market positions and financial stability, which can result in relatively smoother performance.

Summary

In conclusion, the BSE Midcap Index offers valuable insights into the performance of mid-sized companies in the stock market. By keeping an eye on the live chart and understanding the factors influencing its fluctuations, investors can make informed decisions. Stay informed, stay ahead in the world of stock market analysis.

Frequently Asked Questions

What does the BSE Midcap Index represent?

The BSE Midcap Index represents the performance of mid-sized companies listed on the Bombay Stock Exchange.

How are components selected for the BSE Midcap Index?

The components of the BSE Midcap Index are selected based on their market capitalization and liquidity.

How can I interpret the live chart of the BSE Midcap Index?

To interpret the live chart, look for trends, patterns, and key support/resistance levels in the data.

How does the BSE Midcap Index compare to other stock market indices?

The BSE Midcap Index focuses on mid-sized companies, unlike larger indices like Nifty 50 or BSE Sensex.