As the comparison between BSE Midcap Index and Nifty Midcap unfolds, readers are invited into a realm of financial insights that promise to enlighten and captivate.

The following paragraphs will delve into the details of these two indices, shedding light on their performance, sectoral allocation, and market capitalization differences.

Overview of BSE Midcap Index and Nifty Midcap

The BSE Midcap Index and Nifty Midcap are two important indices in the Indian stock market that track the performance of mid-sized companies listed on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) respectively.These indices are significant as they provide investors with a benchmark to evaluate the performance of midcap companies, which typically have a market capitalization between that of large-cap and small-cap companies.

The BSE Midcap Index consists of companies ranked between 101st to 250th by market capitalization on the BSE, while the Nifty Midcap includes companies ranked between 101st to 250th on the NSE.

Composition and Methodology

The composition and methodology of the BSE Midcap Index and Nifty Midcap differ in terms of the companies included and how the index is calculated.

- The BSE Midcap Index includes mid-sized companies listed on the BSE, based on market capitalization, liquidity, and trading activity.

- On the other hand, the Nifty Midcap comprises mid-sized companies listed on the NSE, using similar criteria for selection.

Performance Comparison

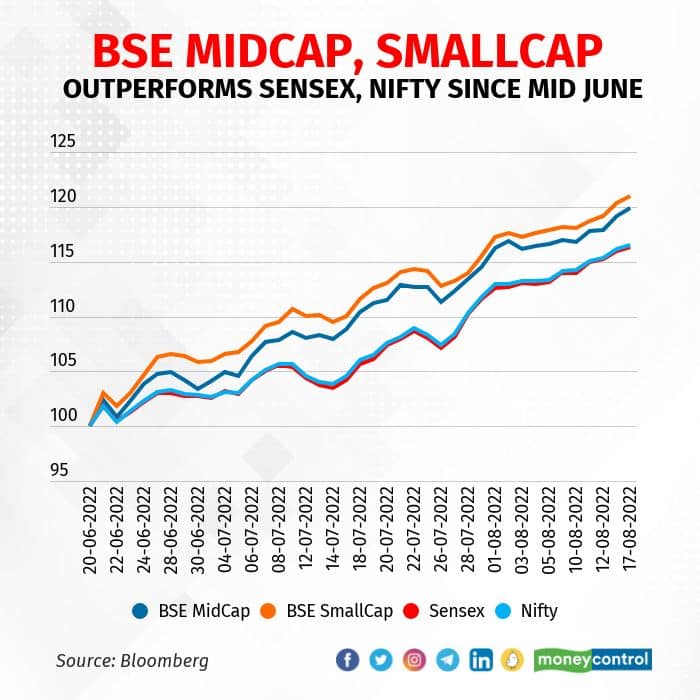

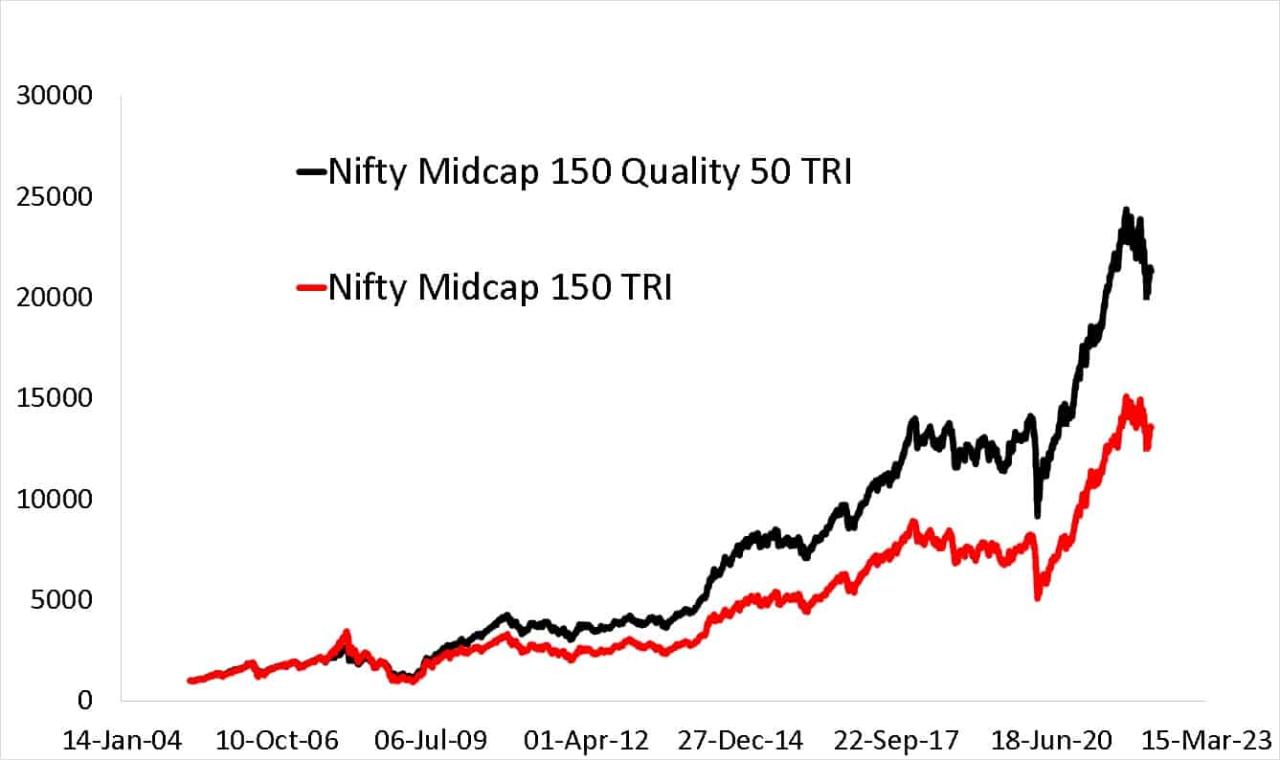

In comparing the historical performance of BSE Midcap Index and Nifty Midcap, we can gain insights into the trends and factors influencing the performance of these midcap indices.

Historical Performance

When looking at the historical performance of BSE Midcap Index and Nifty Midcap, we can see that both indices have shown significant growth over the years. However, there have been periods where one outperformed the other. For example, in certain years, BSE Midcap Index may have shown higher returns compared to Nifty Midcap, and vice versa.

It is important to analyze the reasons behind these fluctuations.

Factors Influencing Performance

Several factors can influence the performance of midcap indices such as BSE Midcap Index and Nifty Midcap. These factors include economic conditions, industry trends, interest rates, corporate earnings, government policies, and global events. A thorough analysis of these factors can help in understanding why one index may perform better than the other in a given period.

Trends and Patterns

In observing the performance comparison between BSE Midcap Index and Nifty Midcap, certain trends and patterns may emerge. For instance, there may be periods where both indices move in tandem, while in other times they may diverge significantly. Identifying these trends and patterns can provide valuable insights for investors and analysts looking to make informed decisions regarding their investment strategies.

Sectoral Allocation

In the world of stock market indices, sectoral allocation plays a crucial role in determining their overall performance. Let's delve into how sectoral distribution impacts the BSE Midcap Index and Nifty Midcap and identify the key sectors that are driving their performance.

Sectoral Allocation of BSE Midcap Index and Nifty Midcap

- The BSE Midcap Index consists of mid-sized companies from various sectors such as financial services, consumer goods, healthcare, and technology. The sectoral allocation is diversified, which helps in spreading risk and capturing growth opportunities across different industries.

- On the other hand, the Nifty Midcap predominantly includes companies from sectors like banking, construction, energy, and manufacturing. The sectoral distribution is also diversified but with a tilt towards specific industries that are characteristic of midcap companies.

Impact of Sectoral Distribution on Performance

- The sectoral distribution of both indices plays a significant role in determining their performance. For instance, if a particular sector is performing well, it can positively impact the overall index performance. Conversely, underperforming sectors can drag down the index returns.

- Diversification across sectors helps in reducing concentration risk and ensures that the performance of the index is not solely dependent on the performance of a specific industry. It provides a more balanced exposure to different sectors of the economy.

Key Sectors Driving Performance

- In recent times, sectors like technology, healthcare, and consumer goods have been instrumental in driving the performance of midcap indices. These sectors have shown robust growth potential and have outperformed other industries.

- Sectors like financial services, manufacturing, and energy also play a crucial role in determining the overall performance of midcap indices. A strong performance in these sectors can lead to positive returns for the index.

Market Capitalization Differences

Market capitalization is a crucial factor in determining the size and scope of an index. The BSE Midcap Index and Nifty Midcap differ in the market capitalization range they cover, which can have significant implications for investors.When it comes to market capitalization, the BSE Midcap Index typically includes companies with a lower market capitalization range compared to the Nifty Midcap.

The BSE Midcap Index covers mid-sized companies, while the Nifty Midcap includes slightly larger midcap companies. This difference in market capitalization range can impact the risk-return profile of these indices.

Implications on Risk-Return Profile

The market capitalization differences between the BSE Midcap Index and Nifty Midcap can influence the risk-return profile of these indices. Generally, midcap stocks are considered to have higher risk compared to large-cap stocks but offer the potential for higher returns.

The BSE Midcap Index, with its lower market capitalization range, may exhibit higher volatility and risk compared to the Nifty Midcap. On the other hand, the Nifty Midcap, including slightly larger midcap companies, may offer a slightly lower risk profile while still providing opportunities for growth.Investors need to consider their risk appetite and investment goals when choosing between the BSE Midcap Index and Nifty Midcap.

The market capitalization differences play a significant role in determining the risk-return dynamics of these indices, and investors should analyze these factors carefully before making investment decisions.

Market Capitalization and Investor Sentiment

Market capitalization also influences investor sentiment towards midcap stocks. Companies with lower market capitalization are often perceived as riskier investments but can also offer the potential for higher returns. The BSE Midcap Index, covering companies with lower market capitalization, may attract investors seeking higher growth opportunities but are willing to take on higher risk.On the other hand, the Nifty Midcap, with its slightly larger market capitalization range, may appeal to investors looking for a balance between risk and return.

The market capitalization differences between these indices can shape investor sentiment towards midcap stocks and impact investment decisions.Overall, understanding the market capitalization differences between the BSE Midcap Index and Nifty Midcap is essential for investors looking to diversify their portfolios and capitalize on the opportunities presented by midcap stocks.

Ending Remarks

In conclusion, the discussion around BSE Midcap Index and Nifty Midcap offers a nuanced perspective on the intricacies of midcap investments in the Indian stock market.

Popular Questions

What is the difference between BSE Midcap Index and Nifty Midcap?

The BSE Midcap Index tracks the performance of mid-sized companies on the Bombay Stock Exchange, while the Nifty Midcap does the same for the National Stock Exchange.

How do sectoral allocations affect the performance of these indices?

The sectoral distribution of companies within these indices can impact their overall performance, as certain sectors may outperform others in different market conditions.

What factors influence the historical performance of BSE Midcap Index and Nifty Midcap?

Market trends, economic conditions, and company-specific factors can all play a role in shaping the historical performance of these midcap indices.